Life assurance – the guaranteed way to cover UK inheritance tax liabilities

25th September 2019

Life assurance has proved itself to be a dependable and a non-controversial way to fund for future UK Inheritance Tax (IHT). No complex planning required, just get through the medical and pay the premiums. Is it really as simple as this?

This Insight looks at the typical uses of, advantages and disadvantages of life assurance for IHT planning. Life assurance, particularly for non-UK domiciliaries (non-doms), can be a simple way of providing for IHT exposure on UK residential property.

Life assurance is far from straightforward when it becomes a valuable part of more complex estate planning; so if you have any questions, please don’t hesitate to contact us.

Types of policy typically encountered

As you will be aware there are a number of lump sum plans available (Discounted Gift Trusts and Loan Trusts being the main ones) but these are essentially investment based plans with very little insurance content. The most commonly used types of life assurance are:

- Term Assurance – Lump sum payable on death, with the term typically set at 10, 15 or 20 years, although it is possible to take out policies for shorter time periods.

- Whole of Life – Lump sum payable on death but no set term. Policies can be on a guaranteed basis, where the premium and sum assured do not change. Policies on a reviewable basis are likely to see the premium increase or the sum assured decrease after the 10th anniversary.

- Gift inter vivos – Covers the tax becoming due on a failed Potentially Exempt Transfer (PET).

- Convertible term – Term assurance policy which can convert into a Whole of Life in the future

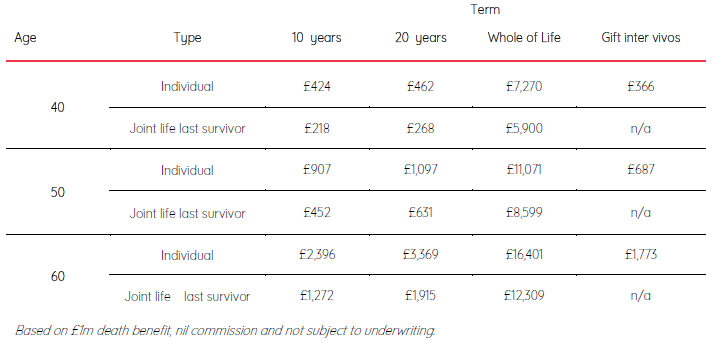

Cost of £1,000,000 in life assurance cover

The type and duration of the life assurance policy will depend on the IHT liability it is covering. Premiums will vary significantly from one type to the other. The adjacent table gives some indicative premiums.

There are a number of life companies (both onshore and offshore) offering high-level cover, which is suitable for IHT planning and it is therefore important to work with an advisor, such as Edison, who has visibility over the entire market. Also premium rates do change regularly.

The figures shown here are whole of market, before individual medical underwriting and exclude commission. Your client may choose to include commission, which would increase the premium, or agree a fixed fee.

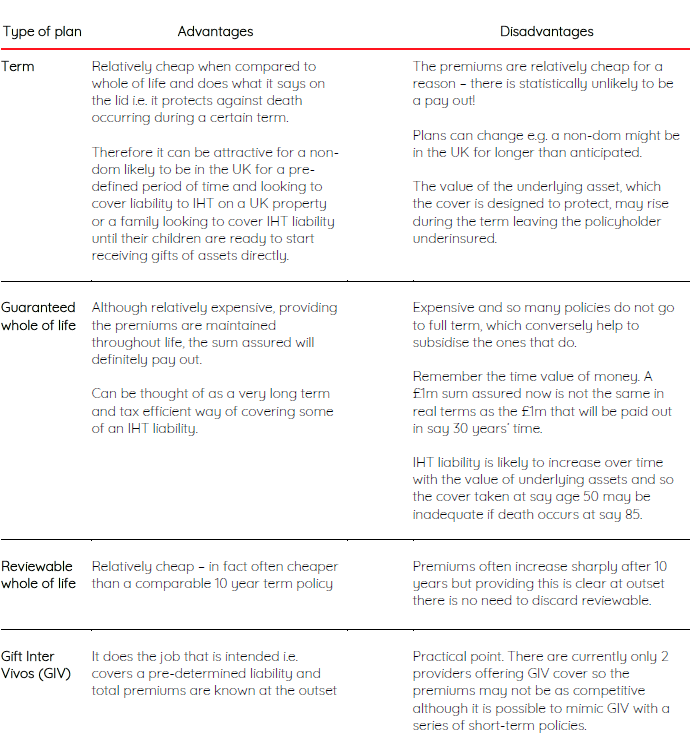

Assessing suitability

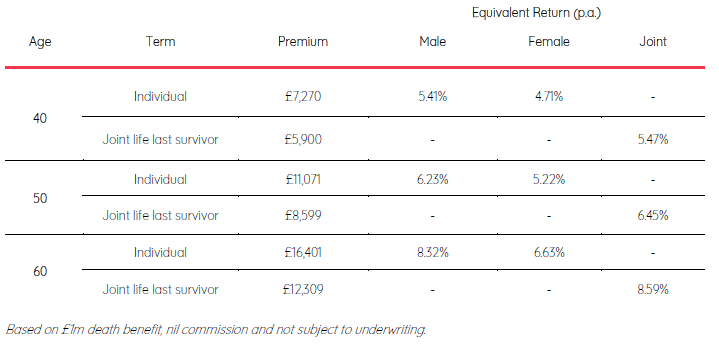

Whole of Life (WOL) and the science behind the guaranteed return

Guaranteed WOL is what it says – guaranteed. Providing premiums are maintained for the rest of the insured’s life and the insurer stays in business, the sum assured will pay out on their death.

For this reason and the fact that life expectancy tables are regularly published, it is possible to calculate the likely return that the sum assured will represent when paid to the beneficiaries of the life insured following their death

Example:

John is aged 50 and in good health. He intends to provide £1m for his children in the future following his death. John’s life expectancy is c. 31 years. The premium for a healthy 50-year-old is approximately £11,071 pa and so the return to normal life expectancy is approximately 6.23% p.a. compound.

In other words, if John set up a savings plan today for £11,071 pa and received an annual return of 6.23% pa his children would receive £1m after 31 years.

“This return will almost certainly be paid to his children free of all taxes.”

There will be no income tax on a guaranteed WOL policy as there is no investment content and there is also unlikely to be IHT as the policy will be held on trust and will therefore not form part of the policyholder’s estate on death. Nonetheless, the payment of premiums to a trust is a transfer of value and must be covered by an appropriate IHT exemption (such as the

£3,000 annual exemption or gifts out of surplus income) otherwise, if exceeding the Nil Rate Band, an immediate charge to IHT can arise on the payment of the premiums.

Of course looking at this another way, £1m today is not the same as £1m paid out in 31 years’ time and if the estimated IHT liability is £1m today it is likely to be far higher 31 years into the future. And if John lives beyond 81 then the return starts to diminish.

Although it is no longer permissible to differentiate between male and female lives in terms of premium, females generally live longer yet now pay equivalent premiums. Therefore they are likely to pay these premiums for longer- hence the effective returns on their policies are likely to be lower.

Is it better to self-fund?

On the basis of the results in this table is it better to self- fund? Although the returns above may be achievable, they would certainly not be guaranteed, and the impact of fees would need to be considered too. Furthermore, even if the required returns can be achieved, can they be delivered tax free?

Whole of Life and RNDs

For non-doms wishing to mitigate IHT on UK residential property there are few remaining solutions. A WOL policy can provide a solution, insuring the value of the UK property x 40% and is (one hopes) immune from future legislative change. It may be possible to build in some indexation to the lump sum to keep pace to an extent with increases in the underlying property value.

Guaranteed WOL policies are generally written by insurance companies resident in the UK and can therefore constitute a UK situs asset for IHT purposes. A non-dom will therefore need advice on an appropriate trust for their estate to avoid UK IHT on the policy payout.

The importance of thoughtful advice

Edison Wealth Management is an independent fee-based financial planning firm. In other words, we do more than just broker life cover, we provide independent advice to help you and your clients achieve the underlying objective(s).

Life assurance is far from straightforward when it becomes a valuable part of more complex estate planning.

At Edison, we understand personal tax, estate and inheritance tax planning, so that we are able to work with you to ensure any life assurance we recommend enhances the planning you are putting in place for your clients.

We can provide you with support on:

- Suitability of various product types and how they meet the objective(s)

- Competitive premiums

- Review of existing life assurance cover

Important Information

The above is a simplification of the legislation. It does not constitute advice. The views expressed above are subject to changes in legislation. Please note that estate planning and trusts are not regulated by the Financial Conduct Authority. The Financial Conduct Authority does not regulate tax advice.

To get in contact to discuss any of the above, please contact:

Scott Inglis

Chartered Financial Planner

020 7287 2225

Scott helps clients structure their wealth in line with their personal aims and ambitions. He is a Chartered Financial Planner and holds advanced qualifications in personal tax and trust planning, pensions, investments and financial planning.

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.