Rough around the hedges

16th December 2019

“It is the part of a wise man to not venture all his eggs in one basket.” So wrote Miguel de Cervantes, gifted Spanish novelist and author of Don Quixote, first published in 1605. The old adage – reminding us all to put money away in different places – is still as relevant 400 years later.

UK investors have long since recognised the many investment opportunities found beyond Britain’s shores. Whether it’s the Silicon Valley tech sector or bonds in global emerging markets, today’s investment landscape makes it ever more possible to send our eggs to baskets in every corner of the world.

But venturing abroad does not come without its own set of new considerations. As well as holding an underlying foreign asset, investors are also buying into the currency in which that asset is denominated. In other words, measuring the performance of Facebook or Amazon shares would mean looking at changes in both the share price and the sterling-dollar exchange rate.

We all pay attention to changes exchange rates when preparing for a holiday abroad. Logic dictates that a weak pound is bad, as it won’t stretch as far when converted to the foreign currency. Spending power has been eroded. Investors should be cautious when applying the same ‘weak pound is bad’ reasoning to foreign investments.

What we will show next is that when an investor’s home currency weakens against a foreign currency, it actually works in their favour. That’s because it boosts the relative value of their overseas holdings. All other things being equal, selling those holdings would generate more pounds when converted back. Of course, the reverse is also true.

A weak ‘home’ currency can work in your favour

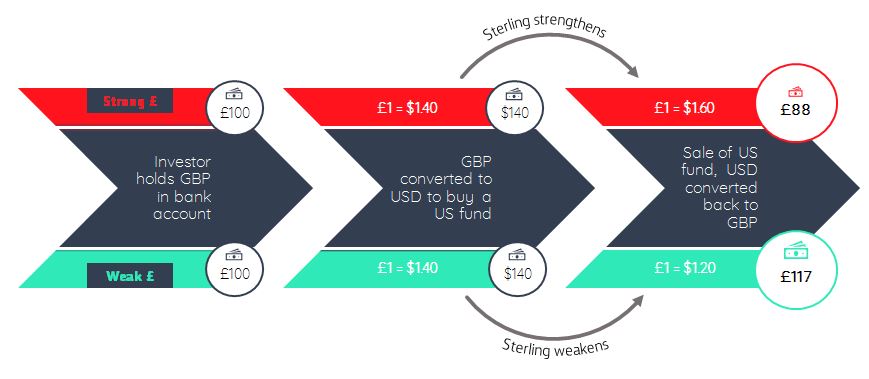

As an example, consider the two timelines in the diagram below. The red pathway along the top illustrates a strengthening pound, with the green reflecting a weakening pound.

In our scenario, a UK investor holds an initial £100 in their bank account. They wish to invest it in a US-based fund, and to do so the £100 is converted to 140 US dollars to buy units in a US fund. In the final step, the investor sells the units in the US fund and receives the proceeds in pounds sterling. The underlying asset performance is completely flat throughout.

The red timeline shows how the original £100 investment is disadvantaged by the strengthening pound. After converting £100 to $140 the pound rises from $1.40 at the start to being worth $1.60 at the point of converting back to pounds sterling. As the underlying US investments remain flat, the exchange rate change reduces the final pound value from £100 to £88.

Conversely, the green timeline illustrates the impact of a weakening pound. After the same series of conversions between pounds and dollars and back, the investor gains £17 on their original £100 investment purely from the dollar being able to ‘buy’ more pounds on the reverse conversion.

Foreign exchange movements can therefore have a significant impact on the performance of investments which are held or denominated in foreign currencies. Unfortunately, such variation can make investments more volatile.

Exchange rate changes can affect investment performance

One way to mitigate that impact might be to simply avoid holding a US fund. But even a UK investor investing only in UK-based assets is not entirely out of the woods when it comes to avoiding the influence of exchange rates.

Take the FTSE 100 index, a collection of the UK’s largest 100 public companies. It is often seen as a barometer of the domestic economy. In reality its constituents, whether it’s Rolls Royce or Vodafone, derive much of their revenue – around 70% on average – from overseas.

Knowing that exchange rates can have an impact on company earnings explains the typically inverse relationship between the FTSE 100 and sterling. As sterling weakens, the index tends to go up, due to companies’ foreign earnings becoming more valuable.

In reality, there is not much an individual investor can do about where Rolls Royce sells its cars or its engines. Luckily however, there are ways investors can manage foreign currency exposure – a process otherwise known as currency hedging.

One of the most accessible options is to invest in funds via currency-hedged share classes. Hedging in this context means protecting against currency movements. It is typically achieved by the fund administrator which uses financial instruments to offset exchange rate changes. It means the investor sees a return which reflects the underlying investment return alone, regardless of the currency in which those investments are denominated.

In our US fund example where underlying performance was flat, the investor would end up receiving the original £100 regardless of whether sterling strengthened or weakened (ignoring charges). Hedging would have separated currency and investment returns, whilst neutralising the former.

In essence, the aim of these share classes is to reduce the impact of large currency swings on fund returns. But buying financial instruments to hedge in this way does not come for free. Share classes adopting these methods typically have slightly higher administrative fees. Moreover, for most long-term investors, short-term fluctuations in currency are expected to eventually cancel out because of shifts in economic cycles. Favourable conditions this year may reverse in the next. For those reasons, hedged fund classes should be bought for a specific purpose.

For a number of months we have been hedging some of the foreign investments in our strategies against fluctuations in sterling. Our assessment was that Brexit would create an unpredictable environment for sterling and that the currency was already at historically very low levels. Under those circumstances, we believe hedging continues to have two main benefits.

The first is to limit volatility. We have regarded Brexit as an issue of significant potential impact to the UK and its currency, of less impact to the EU, and of little impact to the rest of the global economy. With that in mind, hedging against sterling eliminates one possible source of additional volatility.

Secondly, the outcome of Brexit is just as likely to increase as it is to decrease the value of sterling. But any conclusion to Brexit will reduce uncertainty which, in isolation, would likely have a positive impact on sterling. So, we think that on balance sterling has greater capacity to rise than to fall in today’s climate.

We are mindful this is a cautious, short-term position, although the boundaries of ‘short-term’ are being tested by Brexit delays. We too are believers that currency swings smooth out over longer periods.

Cervantes popularised the saying “the proof of the pudding is in the eating” and we have spoons at the ready, reviewing regularly to ensure our hedging strategy is working as we intended, not least because Brexit remains as stubbornly insoluble as ever.

Important Information

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

You can read more about us by visiting our website www.edisonwm.com.

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.