Tax efficient life cover for business owners and high earners

16th October 2019

A Relevant Life Policy (RLP) is an effective alternative to group life assurance cover when it comes to death in service benefits.

It can be just as tax efficient but is not subject to pension legislation. Group life assurance on the other hand usually is subject to pension legislation. This means benefits may be subject to an unexpected tax liability (the pension lifetime allowance charge) of up to 55% on some or all of the sum assured. Poor news indeed for the family of the deceased.

Higher earners, most likely business owners and senior staff, are more at risk of being caught out. Life assurance is a key component of remuneration and staff retention packages, so it’s important to get them right.

How can my death in service get ‘taxed’ as a pension?

Pensions are subject to a Lifetime Allowance of £1,055,000 (19/20 tax year) which increases each year by CPI. Benefits taken above the Lifetime Allowance can be subject to tax of up to 55%.

Since the Lifetime Allowance applies to the total of an individual’s pension benefits, it will include death benefits subject to pension rules, occupational pensions, Self Invested Personal Pensions (SIPP) etc.

On death of the scheme member, under the age of 75, pension benefits can be passed to nominated beneficiaries. This is considered to be a ‘benefit crystallisation event’ and thus can trigger a test against the Lifetime Allowance.

Who is at risk?

Most group life schemes are on multiples of 3 or 4 times salary, so it would not take much to tip an individual over the Lifetime Allowance.

Example

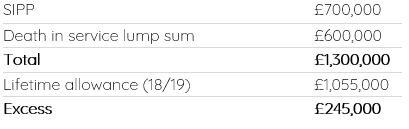

James is the MD of a SME and earns £150,000 pa gross (we’ll ignore bonus etc). He is in his mid 40s, married with two young children, has savings and a mortgage. The company contributes to his SIPP which now has a value of £700,000 and growing. He is a member of the 4x salary death in service plan. The company death benefits are presently the safety net for his family, once the mortgage is paid off. As James is under age 75 and yet to take benefits from his SIPP, both his SIPP and death in service benefits would be tested against the Lifetime Allowance:

The excess of £245,000 would be subject to the lifetime allowance charge, at a % determined by how the benefits are needed by the beneficiaries. If the pension was taken as income and the death in service as a lump sum, almost half of the excess would be taxed at 55% and the remainder at 25%.

Clearly in this case, the total net benefit to James’ beneficiaries is reduced by the additional charge. Something which one presumes James and his beneficiaries would prefer to avoid.

Relevant Life Cover

A Relevant Life Policy (RLP) is similar to personal life assurance but benefits from RLPs are not tested against the Lifetime Allowance.

A RLP pays out a lump sum which can be used for any purpose. Furthermore:

- The sum assured is also typically expressed as a % of remuneration. Unlike traditional group life assurance, remuneration can include salary, bonuses, benefits in kind and regular dividends.

- It’s not uncommon for the sum assured to be 25 x remuneration. The maximum cover will depend on the life assured’s age and level of remuneration.

Tax efficient

Relevant life premiums are normally an allowable business expense and as such, can be deducted against corporation tax. Premiums are not classed as remuneration or P11D benefits, avoiding both income tax and NI. Any pay-out is free from UK income tax, national insurance and capital gains tax. Benefits should also not form part of an individual’s estate for inheritance tax.

Flexibility of benefits

RLPs are useful for building tailored benefits packages.

Tailored benefits – Unlike group life schemes the business can offer different terms to different categories of staff. It may, for example, offer additional cover for higher earning members of staff.

Recruitment – If recruiting an individual with significant pensions accrued elsewhere, a relevant life plan would be a more attractive addition to their overall package as it does not conflict with their pension benefits.

Continuation – Cover can continue even for an individual who is no longer an ‘employee’ which can be attractive as run off cover for business owners and directors.

Small business – A RLP can be implemented for a single member, useful for businesses with a small number of staff.

Competitive premiums

Premiums are subject to underwriting so they will differ. But a RLP with a sum assured of £1,000,000, term of 25 years, for a 50-year-old might cost £120 per month (£1,440 per annum).

Better than personal life assurance?

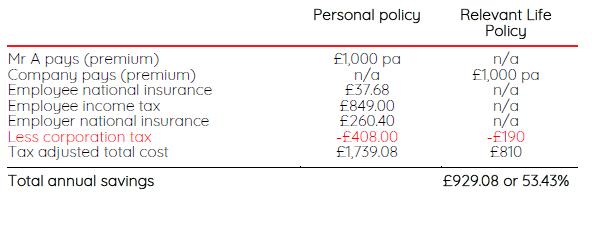

For some business owners and principals, relevant life assurance can sometimes replace personal life insurance policies. The savings can be substantial for both them and the business.

Here we imagine a business owner considering replacing his personal policy, with cover through the business:

Getting the right advice

Our financial planners can guide businesses and individuals on how best to structure their benefits schemes.

We don’t charge for phone calls or an introductory meeting. They provide an opportunity for us to discuss the specific needs, how we can help and to decide on next steps.

If you have any questions on the above or to find out more about our financial planning service, please call 020 7287 2225 or email hello@edisonwm.com.

Important Information

The above is a simplification of the legislation. It does not constitute advice. The views expressed above are based on the legislation applicable on 16th October 2019 which is subject to change. The premiums quoted were produced on 16th October 2019 and are subject to change depending on the insurance market and underwriting. The Financial Conduct Authority does not regulate tax advice.

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.