Budget Summary 2020

Pensions

Tapered annual allowance

Those on higher earnings are subject to taper relief. Taper relief reduces the level of tax relief available on pension contributions. Today’s budget increses the income limits used in calculating the tapered annual allowance and decreases the minimum tapered annual allowance.

Threshold income, which is broadly total income before tax (less employee/personal contributions), is increased from £110,000 to £200,000.

Adjusted income, which is broadly total income before tax plus employer contributions, is increased from £150,000 to £240,000.

The minimum tapered annual allowance is decreased from £10,000 to £4,000.

The measure will have effect for the tax year 2020/21 and will be effective for benefits accrued on or after 6 April 2020.

Proposals to offer greater pay in lieu of pensions for senior clinicians in the NHS pension scheme will not be taken forward.

Those with adjusted income over £300,000 will see a reduction in their annual allowance and will pay more tax as a consequence. Likewise, those with adjusted income below £300,000 are likely to see a reduction in the tax they pay because they are either no longer impacted by the taper and are entitled to the full £40,000 annual allowance, or they are still impacted by the taper, but their tapered annual allowance has increased.

Lifetime allowance

The lifetime allowance will increase in line with CPI for 2020/21, rising to £1,073,100 (from £1,055,000).

Pensions tax relief – net pay / relief at source anomaly

Those earning around or below the level of the personal allowance and saving into a pension with ‘tax relief at source’ method will benefit from a top-up on their pension savings equivalent to the basic rate of tax, even if they pay no tax. This isn’t the case for members of schemes using the ‘net pay’ method of tax relief. The government has committed to reviewing options for addressing these differences and will shortly publish a call for evidence on pensions tax.

Income Tax

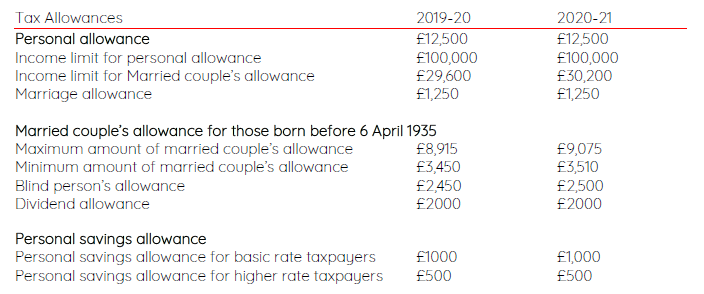

The majority of income tax bands, rates and allowances are remaining the same for 2020/21 as shown below. The personal allowance remains at £12,500 (with reductions applying once adjusted net income exceeds £100,000). The full rates and allowances can be accessed here.

Capital Gains Tax

Annual exempt amount

The Chancellor has increased the Capital Gains Tax annual exempt amount to £12,300 (from £12,000) for individuals and personal representatives, and £6,150 (from £6,000) for trustees of settlements for the period 2020 to 2021.

Entrepreneurs’ Relief – reduction in the lifetime limit

Legislation will be introduced in Finance Bill 2020 reducing the Entrepreneurs’ Relief lifetime limit to a maximum of £1 million.

The rules will also provide that the lifetime limit must take into account the value of Entrepreneurs’ Relief claimed in respect of qualifying gains in the past.

Rules will also be introduced that apply to forestalling arrangements entered into before Budget day. In such cases the disposal will be subject to the £1 million lifetime cap unless:

- The parties to the contract demonstrate that they did not enter into the contract with a purpose of obtaining a tax advantage by reason of the timing rule in section 28 of the Taxation of Chargeable Gains Act 1992, and

- Where the parties to the contract are connected, that the contract was entered into for wholly commercial reasons.

In addition, where shares have been exchanged for those in another company on or after 6 April 2019 but before 11 March 2020, and

- Both companies are owned or controlled by substantially the same persons, or

- Persons who held shares in company A hold a greater percentage of shares in company B than they did in company A and, on 11 March 2020, the personal company test, the trading company and the employee/officer test are met in respect of company B

Then if an election is made under section 169Q of the Taxation of Chargeable Gains Act 1992 on or after 11 March 2020, the share disposal is to be treated as taking place at the time of the election for Entrepreneurs’ Relief purposes, meaning that the new lifetime limit of £1 million will apply.

Savings and investments

Top Slicing Relief on life insurance policy gains from 11 March 2020

Top Slicing Relief (TSR) is a calculation method for working out tax liabilities on withdrawals from life assurance bonds. The personal allowance is to be reinstated within the calculation for TSR making available additional relief for taxpayers in certain circumstances.

The measure will have effect for all relevant gains occurring on or after 11 March 2020.

Starting rate band for savings

The band of savings income that is subject to the 0% starting tax rate will remain at its current level of £5,000 for 2020/21.

Individual Savings Account (ISA) annual subscription limit

The adult ISA annual subscription limit for 2020/21 will remain unchanged at £20,000.

Junior ISA and Child Trust Fund annual subscription limit

The annual subscription limit for Junior ISAs and Child Trust Funds will be increased, quite substantially, from £4,368 to £9,000, meaning that 16/17 year olds can have £29,000 in total (including £20,000 to a cash ISA) added to these tax efficient shelters in 2020/21.

Property tax

Non-UK resident Stamp Duty Land Tax (SDLT) surcharge

The government will introduce a 2% SDLT surcharge on non-UK residents purchasing residential property in England and Northern Ireland from 1 April 2021. This will help to control house price inflation and to support UK residents to get onto and move up the housing ladder. The money raised from the surcharge will be used to help address rough sleeping.

Housing co-operatives: Annual Tax on Enveloped Dwellings (ATED) and Stamp Duty Land Tax (SDLT)

To make the taxation of housing co-operatives fairer, the government will introduce a relief for qualifying housing co-operatives from the ATED and the 15% flat rates of SDLT on purchases of dwellings over £500,000. The SDLT relief in England and Northern Ireland will take effect from Autumn Budget 2020 and the UK-wide ATED relief from 1 April 2021 with a refund available for 2020/21.

Business

Corporation tax (CT) rate

The government will retain the current 19% rate from April 2020. Legislation will also be introduced in Finance Bill 2020 to set the main rate at 19% for the financial year beginning 1 April 2021 also.

Employment Allowance

The maximum Employment Allowance will increase by £1,000 to £4,000 from April 2020. This means eligible businesses and charities will be able to claim a greater reduction on their employer (Secondary Class 1) National Insurance Contributions liability.

The Employment Allowance was introduced in 2014 in the National Insurance Contributions Act 2014 and when it was first introduced was a relief of up to £2,000.

In April 2015, it was reformed to exclude employers of personal or domestic staff (except care or support workers) and from April 2016, the value of the relief was increased to £3,000 and single director companies were excluded.

It is being reformed from April 2020 to restrict access to employers whose National Insurance Contributions liability in the previous tax year was under £100,000.

Taxable benefits and regime for measuring CO2 emissions

This measure affects individuals and employers who provide company cars for employees that are made available for private use.

As announced at autumn Budget 2017, the measure confirms that the carbon dioxide (CO2) emissions figure for the purposes of the company car tax regime and related charges will be based on the Worldwide harmonised Light Vehicle Test Procedure (WLTP) for all new cars registered from 6 April 2020.

More details are available here.

Business rates

Business rates retail discount – The government has already announced that, for one year from 1 April 2020, the business rates retail discount for properties with a rateable value below £51,000 in England will increase from one third to 50% and will be expanded to include cinemas and music venues. To support small businesses in response to Covid-19 the retail discount will be increased to 100% and expanded to include hospitality and leisure businesses for 2021.

Local authorities will be fully compensated for the loss of income as a result of these business rates measures.

Business rates review – The government is launching a fundamental review of business rates to report in the autumn. The Terms of Reference for this review are published alongside the Budget and a call for evidence will be published in the spring.

Review of Enterprise Management Incentives (EMI) scheme

The government will review the EMI scheme to ensure it provides support for high-growth companies to recruit and retain the best talent so they can scale up effectively, and examine whether more companies should be able to access the scheme.

Research & Development Expenditure Credit (RDEC) rate

The rate of RDEC will increase from 12% to 13% from 1 April 2020, supporting businesses investing in R&D and helping to drive innovation in the economy.

Consultation on R&D tax credit qualifying costs

The government will consult on whether expenditure on data and cloud computing should qualify for R&D tax credits.

Digital services tax (DST)

As announced at Budget 2018, the government will introduce a new 2% tax on the revenues certain digital businesses earn from 1 April 2020. This will ensure the amount of tax paid in the UK reflects the value these businesses derive from their interactions with, and the contributions of, an active user base.

Transfer of unlisted securities to connected companies for Stamp Duty and Stamp Duty Reserve Tax

In Finance Act 2018/19, the government introduced a targeted market value rule to prevent artificial reduction of the tax due on share acquisitions when listed shares are transferred to a connected company. This rule is being extended to unlisted shares in Finance Bill 2020 to prevent further tax avoidance. As part of this change, the government will amend legislation to prevent a double tax charge arising on certain company reorganisations.

Consultation on the tax impact of the withdrawal of the London Inter-Bank Offered Rate (LIBOR)

The government will consult to ensure that where tax legislation makes reference to LIBOR it continues to operate effectively. The consultation will also enable the government to ensure it is aware of all the significant tax issues that arise from the reform of LIBOR and other benchmarks.

Response to the independent Loan Charge Review

The Budget confirms the government’s response to Sir Amyas Morse’s Independent Loan Charge Review and sets out the Exchequer costs of accepting the recommendations. These will be legislated for in the forthcoming Finance Bill. To implement the changes, the government will also provide HMRC with additional operational funding. However, disguised remuneration schemes continue to be used. Therefore, the government will shortly issue a call for evidence on further action to stamp out these schemes.

Tackling promoters of tax avoidance

As announced in the government’s response to the independent Loan Charge Review, the government take further action against those who promote and market tax avoidance schemes. The legislation, which will take effect following Royal Assent, will:

- Allow HMRC to obtain information about the enabling of abusive schemes as soon as they are identified by strengthening information powers for HMRC’s existing regime to tackle enablers of tax avoidance schemes

- Ensure enabler penalties are felt without delay for multi-user schemes, meaning anyone enabling tax avoidance arrangements that are later defeated will face a penalty of 100% of the fees they earn

- Enable HMRC to act promptly where promoters fail to provide information on their avoidance schemes. In particular, these changes will help HMRC obtain the information needed to bring a scheme into the Disclosure of Tax Avoidance Schemes regime and empower HMRC to act faster where avoidance schemes are being promoted

- Equip HMRC to more effectively stop promoters from marketing and selling avoidance schemes as early as possible

- Ensure promoters fulfil their obligations under the Promoters of Tax Avoidance Scheme (POTAS) regime, including where they have tried to abuse corporate structures to get around the rules

- Make further technical amendments to the POTAS regime, including preventing spurious legal challenges from disrupting the process of scrutinising promoters, so the regime can continue to operate effectively

- Make additional changes to the General Anti-Abuse Rule (GAAR) so it can be used as intended to tackle avoidance using partnership structures

Important information

This summary is not intended as tax advice. It is for information purposes only so please do not act on the contents without taking expert tax advice first.

Queries on any of the areas covered in this summary should be directed by email or by phone on 020 7287 2225.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.