Our investment views – 2025

24th February 2025

As we do every year, we have undertaken a full deconstruction and rebuilding exercise across our investment strategies. The aim is simple: to ensure that by reassessing risk, return drivers, and fundamental investment theses, we end up with portfolios that are optimised for the future, rather than the narratives of the past.

The first few weeks of 2025 have reminded us that markets are never short of noise – speculation, short-term volatility, and narratives that shift by the day. But a successful portfolio isn’t one that reacts to every twist in sentiment; it’s about filtering out the distractions and focusing on what will drive returns over the long term. Easier said than done.

Intuitively, we know not to put all our eggs in one basket, but how many baskets should we be using? Or in investing terms, how do we allocate across asset classes to ensure the ancient concept of diversification is achieved in modern portfolios?

Our first port of call is to look at the data. We consider both historic analysis and medium to long-term expectations across a wide array of markets and assets. Underpinning our projections is a blend of forecast changes to economic factors (growth, inflation, productivity and demographics) and corporate factors (earnings growth, dividends, margins and valuations). Ensuring a set of robust, objective estimated risk and return figures is a foundational step.

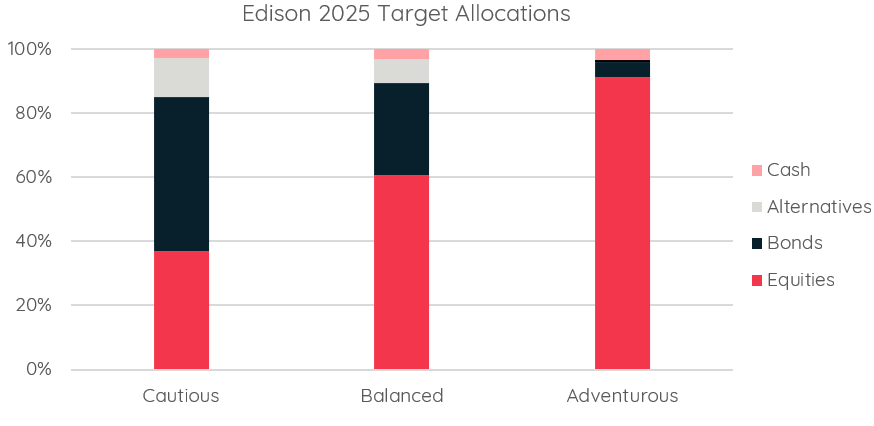

Our optimisation process then reallocates assets between different constituents, whether that’s growth areas such as equities, or more defensive assets like bonds. We also look to embrace new assets classes and investment strategies which thematically align with the long-term goals of the portfolio and the changing market landscape. We end up with an optimal mix – or in other words, one which is maximising expected return for a given level of risk. Our new allocations to each asset class are summarised in the chart below.

Equities

As a result of this analysis, our largest overall equity weighting across all strategies is in the US. There is a strong case for backing companies in the world’s largest economy.

The US has demonstrated remarkable economic resilience and an ability to grow in recent years. It has the highest GDP in the world, holding leadership status in innovation, R&D, and healthcare. The gap is widening too. In 2024 the US economy grew by $1.4 trillion – more than the entire GDP of the Netherlands. GDP per capita (economic output per person) is also the highest of any major country, at over $86,000, with the pace of growth outpacing its peers last year1.

A fundamental driver of this success has been table-topping improvements in labour productivity. The US has had the highest productivity of all countries since 2003, and its outperformance extended further last year2. It has been a beneficiary from advancements in cloud computing, biotechnology, robotics and artificial intelligence (AI) in which the US leads across sectors.

The outcome of the 2024 US election has meaningfully altered the economic trajectory for 2025. A Republican victory ushers in growth-supportive policies underpinned by a rising focus on protectionism, as the US economy turns inward after years of exceptional growth that propped up the global economy.

An expansive fiscal policy combined with significantly higher tariffs is likely to focus attention on inflation. Rising government debt burdens underscore a longer-term challenge: public finances are nearing their limits. In this context, sustained above-target inflation may emerge as a politically and economically palatable mechanism for addressing debt sustainability issues.

Nonetheless, the fundamentals of the US economy remain robust, and its stock and bond markets are the largest and most liquid globally. A strong consumer market, healthy private sector balance sheets, and a historically resilient labour market contribute to the reduced risk of recession in the near-term.

Following a strong run in recent years, the top five stocks in the S&P 500 account for around 30% of the entire index value – the highest level since 1980. There is no denying that US equities are expensive relative to history. By many measures the price tag has been justified by higher earnings. Our analysis suggests a partial allocation to equally weighted US stocks can help counter fears of concentration risk and capture the opportunity in smaller companies as profit growth extends across the index.

Appropriate diversification is a cornerstone of efficient portfolio construction and duly aims to improve the overall risk and return profile. In future, there will inevitably be periods when the US underperforms other equity markets. Take the period 2002-2008 for example, when the US underperformed the rest of the world by 89% cumulatively3. That’s why, while our strategies reflect a positive growth outlook and a preference for the US, we are not neglecting our ‘baskets’ internationally.

Across our strategies, we are allocating to stocks in the UK, Europe, Emerging Markets, Asia Pacific and Japan. These allocations are guided by a quantitative assessment of the trade-offs between and within markets, ensuring a balance between risk and return.

Our approach is driven by two key factors. First, these regions offer attractive long-term risk-adjusted return profiles, supported by favourable valuations, economic fundamentals, and structural growth opportunities. Second, while US equities dominate global benchmarks, many high-growth, successful companies are listed outside the US. Investing in these markets not only provides exposure to compelling opportunities but also enhances portfolio diversification, reducing reliance on a single economic region.

Bonds

In global bonds, we are broadly neutral on ‘duration’. Duration is a measure of how sensitive a bond’s price is to changes in interest rates. Say rates fall 1%, a long duration bond would typically appreciate more than a short duration bond. A neutral stance means we are neither significantly overweight nor underweight interest rate sensitivity relative to the benchmark. Our position reflects a balanced view on yields, acknowledging both the risk of further rate volatility and the potential for central bank easing later in the year.

Bond returns are comprised of two main elements: coupon payments (the regular interest received by bondholders) and price movements (changes in the bond’s market price due to shifts in interest rates, credit risk or market conditions). Compared to recent history, starting yields (coupons) across UK, US and European bonds are generally higher. The reliance on price appreciation as a source of return has diminished. This has improved their long-term risk and return profile and offers better downside protection should interest rates remain elevated.

Within global bonds, we are tilting portfolios to use less GBP hedging than the benchmark, reflecting our view that a modestly higher USD exposure can enhance overall portfolio resilience. Our analysis shows that the US dollar tends to appreciate during periods of market stress, acting as a defensive asset when risk sentiment deteriorates. By maintaining a slightly elevated USD weighting, we aim to improve portfolio risk characteristics, providing an additional layer of diversification and downside protection in volatile market conditions.

Alternatives

To that point, we continue to see a role for liquid (daily-traded) alternative assets in supporting effective diversification across strategies. Traditional portfolios relying only on equities and bonds have faced challenges in environments where inflation and recession risks emerge simultaneously, causing both asset classes to move in tandem. Gold, in particular, has historically served as an effective hedge in such environments. It tends to perform well during inflationary spikes due to its role as a store of value, while also acting as a defensive asset in times of market stress.

Looking to the remainder of 2025, investors once again face a landscape shaped by uncertainty. Shifts in monetary policy, particularly the Federal Reserve’s stance on interest rates, remain a focal point, with speculation on whether economic conditions will warrant stability or further adjustments. Meanwhile, structural themes such as AI and the dominance of a handful of mega-cap technology stocks continue to fuel debate. Broader global dynamics, including geopolitical shifts and the impact of new political leadership, add further complexity to the investment outlook.

Yet, if 2024 taught us anything, it is that markets rarely move in a predictable fashion. Despite concerns and unexpected developments, equities proved resilient, reinforcing the difficulty of timing market shifts with precision. Instead, a disciplined, long-term investment approach remains the most effective way to navigate evolving conditions, ensuring portfolios are positioned to capture opportunities while mitigating risks.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This insight piece does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Insight piece chart source: Edison Wealth Management.

1 Haver Analytics, Bloomberg, Goldman Sachs

2 International Monetary Fund

3 Global Financial Data, Datastream, Goldman Sachs. US equities are based on the S&P 500 Index and non-US equities are based on the MSCI World ex-US Index.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown below. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22. The Financial Conduct Authority does not regulate tax planning or trusts.

The information contained within this insight piece is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases, and reliefs from taxation may be subject to change.

<< Back to InsightsContact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.