The risk of first impressions

3rd May 2018

…Or the first impressions of risk?

Whether it’s an interview or meeting a stranger at a party, experts tell us that first impressions are decided in the blink of an eye. Alexander Todorov, Professor of Psychology at Princeton University, wrote in 2017 that we quickly decide not only whether someone is attractive or not, but also other features like extroversion or dominance. He found that these predominantly subconscious feelings do not just lie dormant, deep in our brains – they are also consequential. Untrustworthy faces are more likely to get harsher legal punishments, whereas trustworthy ones are more likely to get a loan or better financial terms. Politicians with a competent appearance are more likely to get elected. Soldiers appearing dominant are more likely to be promoted. The list goes on.

When it comes to investing, first impressions exist too. The first few months of 2018 have demonstrated much higher levels of volatility compared to the last couple of years. Most equity markets fell in the quarter, meaning all but the most cautious portfolios are likely to have fallen as well.

There is good reason to look beyond market dips

For clients who have only recently started investing, their first and only experience of the markets hasn’t been a particularly positive one. Emotionally, it is undoubtedly much easier to see a portfolio rise in its maiden months or first year. The good news is that according to evidence – and Edison’s last 11 years of investing – there are reasons to be optimistic and look beyond short-term dips.

Equally, for the vast majority of clients who have had a positive first impression, it’s important to remember that it won’t always be plain sailing. From any one year to the next, portfolios can have volatile rates of return. When averaged out over longer periods, this range of returns tends to narrow considerably.

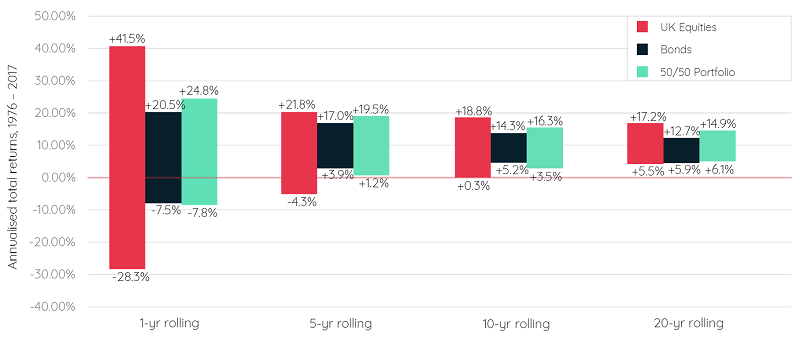

The chart below illustrates the spread of returns over different rolling time periods since 1976. Looking at UK equities, shaded red, the range of returns in any one year has varied from -28% (in 2008) to +42% (1989). A portfolio split 50/50 into equities and bonds has a lower range between -8% and +25%.

But what happens when you look at longer rolling investment periods? Moving rightwards across the chart we can see that a diversified portfolio has not had a negative return in any five year rolling period. Indeed, its worst five year return has been an annualised +1.2%. Likewise, neither UK equities, bonds, nor a 50/50 portfolio have had a single negative 10 or 20 year period since 1976.

Just as physical first impressions can influence how we think about people, in finance periods of volatility can create instinctive, but not necessarily rational, investment bias. Setting longer term goals, clear strategies and expectations is key to a suitable investment approach, but it is perfectly natural to be dismayed by a poor start. The evidence however overwhelmingly suggests that sticking with it often yields better results than acting on short term bias.

Important Information

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

This document does not constitute advice.

The above charts are for illustrative purposes only.

Where referred to, ‘Global Bonds’ and ‘US Large-Cap Blend Equities’ are based on the Morningstar open-ended categories. The example is based on hypothetical and simulated modelling which has many inherent limitations and is generally prepared with the benefit of hindsight.

There are frequently sharp differences between simulated results and the actual results. There are numerous factors related to the markets in general or the implementation of any specific investment strategy which cannot be fully accounted for in the preparation of simulated results and all of which can adversely affect actual results. No guarantee is being made that the stated results will be achieved.

The period used for our analysis is 1 January 1996 to 31 December 2016. The graph above spans, including the dashed lines, the period 1 January 1996 to 30 June 2017.

Data sourced from Morningstar.

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.