Liquidate or accumulate?

22nd November 2024

Donald Trump’s imminent return to the White House poses a stark shift in the tone and direction of US politics. It follows a year of global elections, technology breakthroughs, and geopolitical shifts. A lot can happen in a short space of time which creates questions about how to navigate turbulent periods.

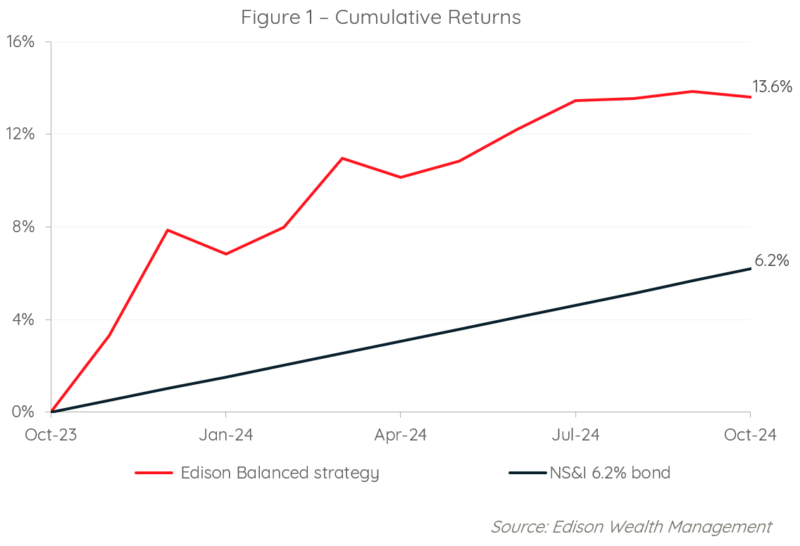

Cast our minds back to October 2023 and many UK investors were faced with a difficult choice: lock in a guaranteed 6.2% from NS&I’s twelve-month savings bond or stay the course with their portfolios, which had experienced a period of shaky performance at the time. The headline-grabbing savings bond appeared attractive, especially against the backdrop of volatile markets.

One year on and that bond has now matured. Was NS&I’s savings bond better than staying invested? And given rising uncertainty in recent months, does cash make sense today?

High Cash Rates

During 2023, cash interest rates reached levels we hadn’t seen in years. With rates surging, so did the temptation to park funds in savings accounts or fixed term bonds like the NS&I 6.2% option. To an anxious mind, a guaranteed return feels like a safe haven, with no exposure to market volatility. We understood the appeal, but we also knew that long-term investment strategies should not be swayed by a short-term illusion of security.

While the NS&I bond offered a temporary cushion, it was important to consider the bigger picture. Realising a loss at the bottom of a dip, then waiting out the markets in cash, rarely leads to optimal outcomes. Markets, by nature, recover, and being invested when that recovery happens is essential to building long-term wealth. It is a clear, repeating pattern, backed by decades of evidence.

Performance

A year later, across both unconstrained and sustainable approaches, our portfolios have delivered returns of between +11% and +19% – practically double (and beyond) what the NS&I bond provided. The chart below illustrates Edison’s unconstrained Balanced strategy versus NS&I. This performance highlights the benefits of staying invested throughout volatile periods. Markets have rebounded, and those who kept their portfolios intact were well-positioned to capture these gains.

This illustrates an important point: volatility is part of investing, but it shouldn’t lead to rash decisions. Those who shifted into cash missed out on the recovery and now face a changing environment for interest rates with fewer attractive alternatives.

Staying Invested

Today, central banks are gradually lowering base rates. With interest rates falling, bond markets are no longer offering the same attractive yields. Investors who opted for NS&I’s savings bond are back to square one, needing to find new investment opportunities.

Meanwhile, financial markets have already rebounded, meaning if they started investing now, they would be buying in at a higher price. In contrast, those who stayed invested in their portfolios have likely benefited from market recovery and are positioned to continue capturing returns in the years to come.

The decision to stay invested, even when markets are down, is underpinned by a fundamental truth: markets rise and fall, but over the long-term, they tend to reward patience. Timing the market by shifting into cash when things look uncertain often leads to missing the best recovery days – an essential part of regaining losses.

It’s also true that the forces that drive returns are largely unpredictable in the short-term. The only way to guarantee capturing them is by being invested.

Cash Today

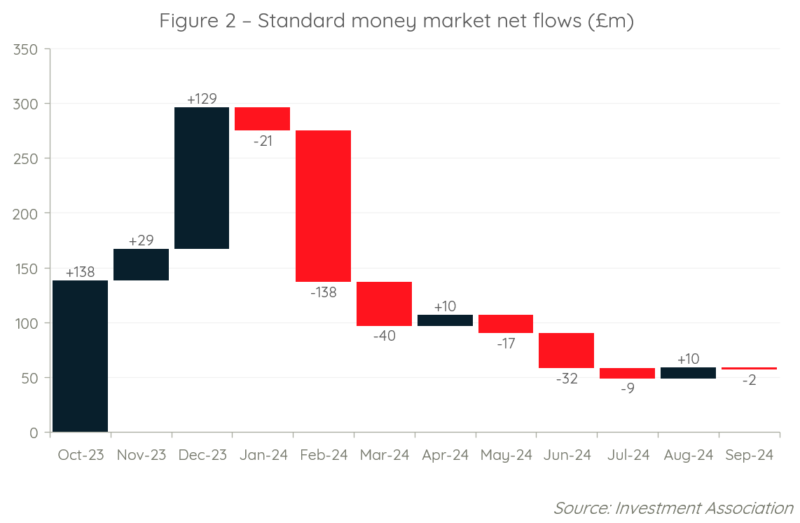

As interest rates begin to fall and inflation continues to pose a challenge, the allure of holding cash has diminished compared to a year ago. That has been reflected in declines in flows into money market funds, as shown in the chart below.

Cash savings today are offering significantly lower returns compared to equities and bonds, which continue to provide the potential for higher returns over time.

As we look ahead, it’s worth remembering the importance of maintaining a long-term view. While cash looked attractive a year ago, our investment strategies have outperformed significantly. We encouraged patience, and the results speak for themselves: staying invested through the market’s ups and downs has proven to be the right decision.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

All the performance data used in this document has been sourced from Morningstar and investment performance is calculated using Time-Weighted Return. All performance figures are net of each underlying investment managers’ annual management charges and administrative expenses, but do not include transaction charges or any other charges associated with third party products (e.g. pension products or platform charges).

| Edison (net %) |

‘19 |

‘20 | ‘21 | ‘22 | ‘23 |

‘24 |

| Balanced |

+15.2 |

+4.7 | +9.6 | -11.4 | +7.5 |

+5.3 |

The above table contains discrete annual performance data for Edison’s unconstrained Balanced strategy, net of Edison’s charge for investment management. The table covers the past five full calendar years, up to the end of the latest quarter. As a result, some performance figures may not cover a full calendar year. Edison’s charge for investment management is outlined in the Client Agreement.

Figure 1 source: Edison Wealth Management. Where referenced Edison performance relates to 01/11/2023 to 31/10/2024, gross of fees.

Figure 2 source: Investment Association.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22. The Financial Conduct Authority does not regulate tax planning or trusts.

The information contained within this document is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases, and reliefs from taxation may be subject to change.

<< Back to InsightsContact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.