Blue chips and dips

17th May 2022

The intersection of global geopolitics, economics, and policy has provided a challenging and unsettled start to 2022. Russia, inflation, and a mounting cost of living crisis have driven an increase in volatility in financial markets which has resulted in a period of raised anxiety for investors.

While it may be difficult to remain level-headed during a market decline, it is important to remember that volatility is a normal part of investing. Additionally, in the context of long-term objectives, reacting emotionally to volatile markets can be more detrimental to performance than the downturn itself.

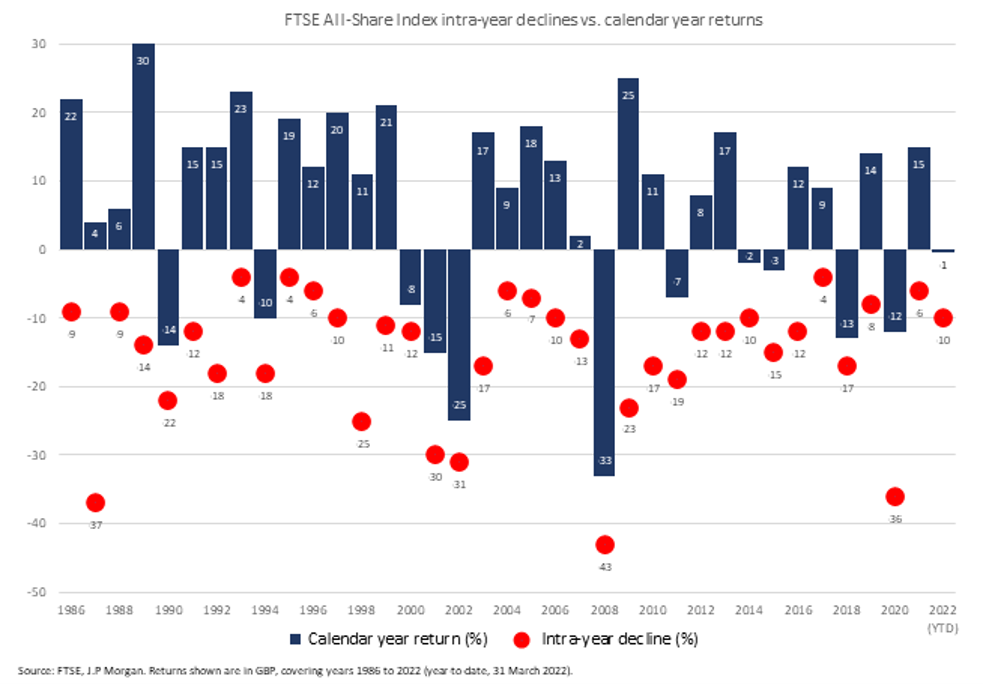

The chart below illustrates calendar-year returns for the UK stock market since 1986, as well as the maximum declines within each of those years (red dots).

During this period, the average intra-year drop was -15%. Over 70% of the years within this period experienced declines of more than 10%, and over a third had a fall of more than 15%.

Yet, despite the frequency of these large drops in the stock market, calendar year returns were positive in 25 of the 37 years analysed (68%). Overall, the average calendar year return was +6%.

This analysis shows us just how common corrections can be, and how hard it is to assess whether a large intra-year fall will precede negative returns for the year as a whole. Historically, the stock market’s general direction has been up. But during a given year, significant drawdowns have been common.

It’s clear that, while unsettling, market volatility is inevitable and a completely normal feature of investing. The challenge is to not let market declines derail portfolios from their long-term goals. Because time after time, stock markets have recovered from the disruptive (but ultimately short-term) declines and gone on to post gains.

What’s more, trying to time the market requires a virtually impossible degree of luck to get right. The margin of error is big as investors need to get two decisions spot-on; when to sell large portions to cash and then when to buy back. On this theme, we’ve previously explored the importance of not missing the best days in the market.

Together, this signals the best antidote to volatility is a resolute focus on long-term outcomes, knowing that a dip rarely spells disaster.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.