Unused income tax relief on pension contributions; use it or lose it.

7th January 2020

Carry forward is a mechanism for making the most of unused pension contribution allowances from previous years, and the income tax relief that comes with them.

It could allow an individual who has already used the current year’s annual allowance to contribute up to another £120,000 and benefit from tax relief at their marginal rate. This could allow an additional rate taxpayer to receive additional tax relief of £54,000 on an additional £120,000 personal pension contribution in the current tax year (19/20).

Who it could benefit?

- High earners, namely those paying higher rates of income tax.

- Individuals with irregular or flexible earnings, who are in a position to make large contributions.

- Business owners.

- Members of defined benefit pension schemes (e.g. final salary schemes).

- Individuals who have returned to the UK after a period of non-residence.

What is Carry Forward?

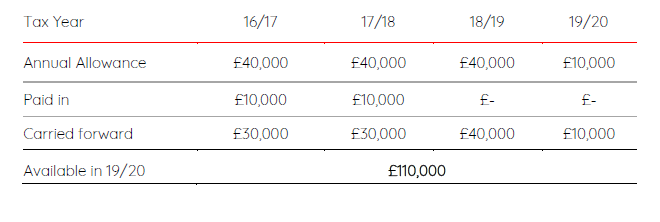

Carry forward is the recovery of unused Annual Allowances from the previous three tax years. In the table below, an individual has made the following contributions in this and the previous 3 tax years

In the above example, the individual had adjusted income greater than £210,000 in the current tax year, which meant their annual allowance tapered to £10,000. This, with the unused allowances carried forward from the previous three tax years, provides a total available contribution of £110,000 for tax year 2019/20.

How is carry forward claimed?

An individual must firstly use the current year Annual Allowance in full before they may utilise carry forward. They must also earn at least the amount they wish to contribute in total during the tax year (unless their employer is making the contribution). The individual must also have been a member of a UK registered pension scheme in each of the tax years from which they wish to carry forward. It is not necessary to make any claim to HMRC to carry forward unused Annual Allowance.

Use it or lose it

Unless action is taken, any unused allowance from 2016/17 will be lost from 6th April 2020.

Getting it right

The current cap on the value of total pension benefits that can be accrued without suffering a tax charge is £1,055,000 where someone has not applied for and been granted a protected lifetime allowance. Any benefits in excess of this, or their protected amount including defined benefit pensions, will be potentially subject to an additional tax charge that can negate the benefits of tax relief on contributions. It is therefore important to contribute an amount which maximises tax relief today, without running the risk of exceeding the cap in future years.

How we can help

Pensions continue to be an attractive long-term investment vehicle, especially now they can, in many cases, be accessed more easily on retirement and passed on tax efficiently to beneficiaries. We can help individuals with planning the appropriate level of pension contributions in order to avoid charges.

If you have any questions on the above or to find out more about our financial planning service, please call 020 7287 2225 or email hello@edisonwm.com.

Important Information

The above is a simplification of the legislation. It does not constitute advice. This piece was written based on the legislation applicable at the time. The views expressed above are subject to changes in legislation. The Financial Conduct Authority does not regulate tax advice.

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.