Our investment views – 2026

5th February 2026

Over long time periods, investment returns are primarily determined by a set of strategic choices around how and where to invest. The types of assets and their regional exposures become key building blocks. So does sticking to those strategic choices when there are short term fluctuations creating distraction and temptation.

As part of our annual review, we reassess the structural and quantitative factors influencing risk and return across these global assets and markets. This gives us an idea of whether any adjustments need to be made. The aim is to end up with a set of portfolios that have been carefully optimised to generate as much return for as little risk as possible.

Given our preference for science over speculation, our first port of call is a vast array of data. We consider both historic analysis and medium to long-term forward expectations across a wide range of markets and assets. Underpinning our projections is a blend of forecast changes to economic factors (growth, inflation, productivity and demographics) and corporate factors (earnings growth, dividends, margins and valuations). Ensuring a set of robust, objective risk and return estimates is a foundational step.

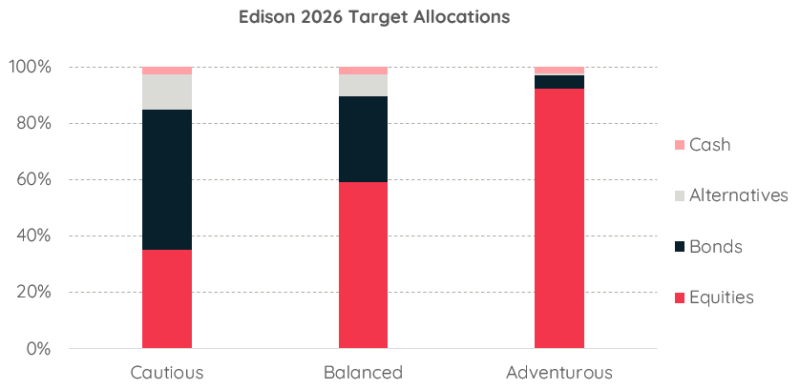

Our optimisation process then reallocates assets between different constituents, whether that’s growth areas such as equities, or more defensive assets like bonds. We also look to embrace new asset classes and investment strategies which thematically align with the long-term goals of the portfolio and the changing market landscape. We end up with an optimal mix – or in other words, one which is maximising expected return for a given level of risk. Our new allocations to each asset class are summarised in the chart on the next page.

The outcome of this process is rarely a dramatic shift in strategy, but a set of measured adjustments reflecting how the opportunity set is evolving. The defining feature of the current environment is not a lack of opportunity, but a broadening of it. After several years in which returns were driven by a narrow group of markets and companies, leadership is becoming less concentrated, increasing the importance of regional and asset-class level diversification.

Equities

Within equities, the US remains our largest regional exposure. The US continues to combine scale, liquidity and depth of capital markets with global leadership in innovation, productivity and corporate profitability. The resilience of the US economy has been supported not only by corporate investment – particularly in AI-related infrastructure – but also by the strength of household balance sheets, which has helped sustain consumption even as growth moderates. While valuations are higher than in other regions, the fundamental strength and breadth of the US market justify its continued prominence within portfolios.

Alongside this, we have modestly increased exposure to Emerging Market and Asia Pacific equities. These regions increasingly sit at the intersection of several important long-term themes. Exposure to AI through markets such as Taiwan and South Korea is one example, but the opportunity extends beyond technology alone. A weaker US dollar and sustained capital investment linked to digital infrastructure have improved the long-term risk and return profile across parts of the region.

China remains a more selective and nuanced allocation within this broader emerging market exposure. Structural challenges related to property, demographics and policy continue to constrain growth potential. However, signs of stabilisation and more targeted policy support suggest that China does not need to reaccelerate sharply to influence global supply chains, commodity demand and wider emerging market dynamics.

By contrast, return expectations across Europe and the UK are more muted after a strong year of outperformance. While fundamentals remain broadly sound, valuation gaps between regions have narrowed and productivity growth continues to lag that of the US. Weaker levels of business investment, alongside sector compositions less exposed to global growth and innovation themes, continue to weigh on longer-term prospects. That said, selective domestic tailwinds are beginning to emerge in Europe, with signs of a more expansionary fiscal stance in Germany particularly significant given its influence on the wider European economy.

Reflecting this balance of opportunities, we have increased allocations to Emerging Market and Asia Pacific equities across our strategies. This has been funded through modest reallocations from Europe and the UK, where relative opportunity appears less compelling compared to our previous review. Both regions remain an important part of the equity allocation, contributing diversification across sectors and sources of return.

Bonds

Within bonds, we remain broadly neutral on ‘duration’ – a measure of how sensitive a bond’s price is to changes in interest rates – relative to our peer group. With inflation volatility likely to persist and a wide range of potential paths for interest rates over the coming year (and beyond), we believe a balanced approach is appropriate. This positioning allows portfolios to participate if central banks continue to cut rates, while retaining protection against renewed yield volatility or upward inflation surprises.

From a currency perspective, we continue to hedge approximately 90% of our global bond exposure. This reflects our view that currency volatility should not be a dominant driver of bond returns within portfolios. At the same time, we retain a modest level of unhedged dollar exposure, recognising the dollar’s tendency to provide protection during periods of market stress and heightened risk aversion (albeit a feature that has been tested in recent years).

Alternatives

Alternatives continue to play an important role in supporting portfolio resilience. Environments characterised by inflation volatility, fiscal pressures and geopolitical uncertainty can challenge traditional equity-bond relationships, increasing the value of assets that behave differently. Recent episodes of volatility in government bond markets have underlined how quickly policy uncertainty can feed through to asset prices, reinforcing the role of diversifiers in maintaining balance and stability within portfolios.

Gold remains a strategic allocation within this context. Its role extends beyond that of a traditional safe haven. In recent years, gold has increasingly reflected demand from investors and central banks seeking diversification away from concentrated currency exposure and protection against policy uncertainty.

While periods of consolidation should be expected following a stretch of strong performance, the structural drivers underpinning gold’s role – diversification, resilience during market stress and protection against inflation volatility – remain in place.

Looking Ahead

The investment backdrop entering 2026 is more constructive than many investors might have predicted this time last year, but it is not without risk. Global growth remains intact, policy settings are gradually becoming more supportive and corporate balance sheets are generally sound. At the same time, asset prices already reflect a reasonable degree of optimism, which places greater emphasis on earnings delivery, selectivity and portfolio balance.

In this environment, we do not believe successful outcomes will be driven by a narrow set of market leaders or a single economic scenario. Instead, returns are more likely to come from exposure to a broader range of regions, sectors and return drivers, combined with disciplined risk management. That philosophy underpins our current positioning: maintaining meaningful exposure to the US, increasing participation in Emerging Market and Asia Pacific opportunities, and retaining diversification across developed markets, bonds and alternatives.

Uncertainty around inflation, policy and geopolitics is likely to persist, and different risks will dominate at different points in the cycle. Our objective remains unchanged. We continue to position portfolios with a long-term perspective, grounded in diversification, balance and evidence-led decision-making, ensuring they are well placed to capture opportunities while managing risk thoughtfully as the global environment evolves.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This insight piece does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Insight piece sources:

Chart – Edison Wealth Management 2026.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown below. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22. The Financial Conduct Authority does not regulate tax planning or trusts.

The information contained within this insight piece is based on our understanding of legislation, whether proposed or in force, and market practice at the time of writing. Levels, bases, and reliefs from taxation may be subject to change.

<< Back to InsightsContact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.