Has America sneezed?

1st September 2023

Since the Great Depression of 1929, economists have quipped “When America sneezes, the world catches a cold”. The phrase can trace its roots even further back, to Austrian Chancellor Metternich’s writings in 1830 during the French revolution.

Today, it serves as a poignant reminder of the interconnectedness that defines our modern global economic landscape. The United States, with its mammoth economic influence, acts as both a beacon of prosperity and a precursor to uncertainty, casting ripples that traverse international borders.

In the wake of the economic challenges of 2020, inflation and rising interest rates are providing a new headache for households and investors. As higher interest rates begin to bite, the global economy is looking to be heading towards either a “soft-landing” – a cyclical slowdown that avoids recession – or a “hard-landing” – an economic downturn. Each could hold significantly different implications for financial markets.

Key recession signals

In April, the Federal Reserve (Fed) projected that the US would enter recession in the second half of 2023 – recession being defined as two consecutive quarters (six months) of negative gross domestic product (GDP) growth. There are a range of factors that supported this forecast, namely the impact that contractionary monetary policy – interest rate hikes – has on the economic health of a country.

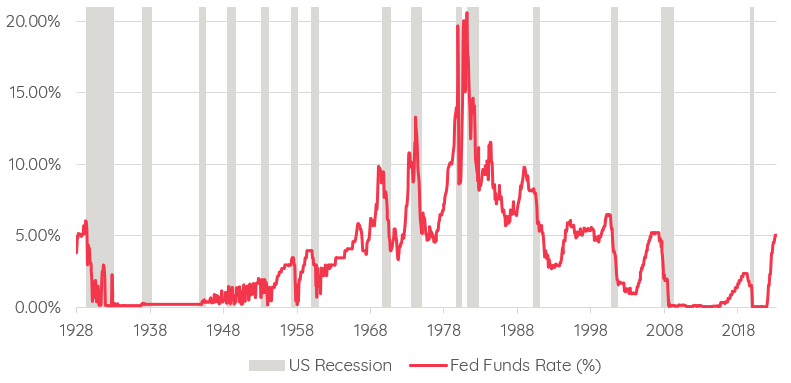

The US Fed Funds Rate – the benchmark interest rate set by the Fed – has seen 11 consecutive hikes from 0.25% in March 2022 to 5.25% in July 2023. For 18 months then, the possibility of a slowdown has been incredibly well signposted; higher rates tend to raise borrowing costs, hampering consumer spending and business investment, thus stifling global economic activity. One consequence is an unusual move in the yield curve to an inverted position – something the US has experienced since April 2022.

A yield curve plots the level of interest on bonds over different time periods. But really it measures the market’s feelings about risk. Typically, investors are rewarded with higher rates for owning bonds that are tied up for longer. The yield curve would therefore slope upwards.

An inverted yield curve occurs when interest rates go down the longer that money is tied up. While this is counterintuitive, it indicates pessimism about the economy’s future such that investors are willing to accept lower returns on their long-term bond assets. Historically, periods of recession lag 18 months behind the point of inversion.

As seen in Chart 1, recession in the US (marked by the shaded grey areas) has historically followed Fed interest rate hikes.

Chart 1

But recessions are a lagging indicator of economic performance, with GDP data released approximately 6 weeks after each quarter ends. It is impossible to confirm if the recession threshold has been met until this data is known. According to the IMF, the typical length of a recession is 1-year, meaning that by the time a recession is confirmed, it is already half-way through its cycle on average. Market participants keep a close eye on various metrics other than GDP growth, so often the impacts of recession are priced in before the point it is announced.

For now, the US economy appears to be a far cry from an economy in decline. In Q2, US GDP grew by 2.4% compared to the previous quarter, ahead of most estimates and marking a fourth consecutive quarterly figure above 2%. So, has the US defied all expectations, or is the worst yet to come?

The economic outlook

The Global Financial Crisis (GFC) and Covid-19 pandemic produced significant market drawdowns. Investor confidence was rocked, and in both cases, global economic activity nosedived. Skip to 2023, and market participants are rightfully cautious when suggestions of recession start to appear once more. This time seems different.

Past crashes in 2007/8 and 2020 were triggered by deep, unforeseen shocks in the market, but in 2023 the proven link between interest rate hikes and recession adds an element of inevitability – or at least, it should. The Fed’s July update shifted from projecting a full-blown recession to a gentler economic slowdown, driven by robust US economic data.

High inflation in the US has been controlled at a faster pace than the rest of the world, with expectations that Fed interest rates are nearing a peak. The US inflation rate in July was 3.2%, down from a high of 9.1% in June 2022.

Labour markets have remained strong, with the US unemployment rate contained below 4% over the past 18 months. Wage growth in the US has showed signs of slowing, with a declining ‘quit rate’, and an increase in net migration – back to 2017 levels – providing a boost to labour supply.

Elsewhere in the economy, there has been strength in the service sector, which has benefited as consumers begin to spend on experiences after a build-up of excess savings during Covid-19.

All told, there are reasons to remain hopeful for a soft-landing in the US. But there are risks on the horizon. Inflation rarely moves in neat lines; it wouldn’t take much to force the Fed into maintaining higher interest rates for longer, creating tighter credit conditions and a greater risk of a deep recession.

Then there are factors outside of policymakers’ control. Geopolitical shocks, including further escalations between Russia-Ukraine, and China-Taiwan, could put pressure once again oil and food prices.

Markets and recessions

There are no cheat codes when it comes to investing during a recession, and no sure-fire ways to guarantee outperformance. What we do know, however, is that markets tend to react quicker than lagging indicators.

Repositioning in response to a recession exposes the inevitability of ‘selling low, buying high’ and risks missing out on the best days in the market.

Equally, as we discussed in our Insight Piece, ‘How recessions impact returns’ from August 2022, there can be pitfalls in making big calls during periods of uncertainty. It is human nature to be more scared of the bad news than excited for the good. But knee-jerk reactions rarely improve long-term outcomes.

Navigating the current period

The US economy is holding up better than many expected. Inflation is trending down. Yet the markets are treading water as the health of the US economy hangs in the balance.

Our view is that there is chance inflation proves more difficult to control than recent history has proved, but it will eventually be brought under control. Getting a clearer picture of the economic cost will, however, take time. While the question of US recession remains open, it pays to prepare for a range of scenarios until the uncertainty settles.

We see value in diversifying bond and equity allocations across developed and emerging markets. Some emerging market economies have even begun cutting interest rates following steep local declines in inflation. It may be some time before similar moves are mirrored in countries such as the UK and US. We reiterate our broad view that markets do recover and, regardless of inflation this month or next, it pays to be invested for when better times come once again.

If you have any questions on the above or to find out more about our investment service, please call 020 7287 2225 or email hello@edisonwm.com.

Important information

This document does not constitute advice.

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future.

Insight piece Chart 1 sources: Federal Reserve, Macro Trends. US Federal Funds rate used from 1928 – 1954. Effective Federal Funds Rate (EFFR) used from 1954 – 2023. The US Federal Funds Rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. EFFR is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market Rates.

Edison Wealth Management Limited is authorised and regulated by the Financial Conduct Authority. The company is registered in England and Wales and its registered address is shown above. The company’s registration number is 06198377 and its VAT registration number is 909 8003 22.

<< Back to Insights

Contact us to see how we can help.

+44 (0) 20 7287 2225

hello@edisonwm.com

The value of investments and the income arising from them can go down as well as up and is not guaranteed, which means that you may not get back what you invested. Past performance is not necessarily a guide to the future. The information contained in this website does not constitute advice. The FCA does not regulate tax advice. The FCA does not regulate advice on Wills and Powers of Attorney. The Financial Ombudsman Service is available to sort out individual complaints that clients and financial services businesses aren’t able to resolve themselves. To contact the Financial Ombudsman Service please visit www.financial-ombudsman.org.uk.